Thursday 31 December 2015

Sunday 13 December 2015

GET READY FOR SERIOUS STRUGGLES INCLUDING INDEFINITE STRIKE IN NEW YEAR ,2016.

No. R-III/Circular-26/2015 Dated 11-12-2015

To

All CWC Members, Circle, Divisional and Branch Secretaries.

HAPPY AND PROSSPEROUS NEW YEAR -2016 TO ALL

GET READY FOR SERIOUS STRUGGLES INCLUDING INDEFINITE STRIKE IN NEW YEAR ,2016.

Dear Comrades,

All India RMS & MMS Employees Union Group `C` CHQ congratulates and Red Salute to CWC members, Circle Secretaries, Divisional Secretaries and Branch Secretaries,office bearers and members for participating and making a grand success of all programmes.All IndiaProtest Day on 19-11-2015 was observed by holding dharna at Jantar Mantar , Black Day observed wearing black badges, Rally , Demonstration on 27-11-2015. Hunger Fast on 1-12-2015 called by NJCA, Confederation and NFPE respectively. Now CHQ appeal to all to mobilize Rank& File and participate and make a grand success Indefinite Strike from First week of March 2016 for settlement of 25 Point Charter of Demands called by NJCA. .

POSTSL JCA MEETING:- Postal JCA (NFPE & FNPO) meeting was held on 08-12-2015 in NFPE office for modification on 31 Points which were rejected by 7 CPC. A joint Note on 31 Points was prepared and submitted to Secretary (Posts) on 08-12-2012 in Departmental (JCM) meeting held on 08-12-2015 at 11.00 AM.

DEPARTMENTAL COUNCIL MEETING HELD ON 08-12-2015:- Departmental Council (JCM) Meeting was held on 08-12-2015 on 7 CPC reommendtions. PJCA submitted the joint Note requesting modifications in the recommendations of 7 CPC including higher Pay Scales of PA/SA, Postman, MTS, PO & RMS Accountants, LSG, HSG-II, HSG-I, SBCO, Admn,Driver,Artisan, merger of Deaspatch Rider, removal of Bench mark “Very Good” on MACP, restore Family Planing Allowance, Suprintendent Sorting upgradation to Grade Pay of Rs.4800/- etc. Each point was discussed and views of the Postal Board of these issues were positive.Full Note is available on web site.

NJCA MEETING :- Meeting of the National Joint Council of Action (Railways, Defence and Confederation) was held on 08.12.2015 at JCM National Council Staff Side office, New Delhi. Detailed deliberations on 7thi CPC related issues (including Gramin Dak Sewaks and Casual, Contract and daily-rated workers) was held and a Common charter of demands was finalized. It is further decided that the NJCA shall go on indefinite strike from the 1st week of March 2016, if the Government fails to reach a negotiated settlement with the staff side before 1st week of February 2016. A letter intimating this decision will be given to the Government shortly along with the common Charter of Demands which is enclosed.

PAYMENT OF QUOTA:- All Circle/Divisional /Branch Secretaries are requested to clear arrears of quota to CHQ without delay and remit in future regularly.RMS Worker will not be posted to those branches in arrears for more than 3 months.

With best wishes.

Yours comradely,

(Giri Raj Singh) General Secretary

CHARTER OF DEMANDS

1. Re-compute the minimum wage on the basis of the actual commodity prices as on 1.7.2015 and factor the Dr. Aykroyd formula stipulated percentages for housing and social obligations, children education etc. Revise the fitment formula and pay levels on the basis of the so determined minimum wage;

2. Revise the pay matrix basing upon the revised minimum wage and rounding off the stages to the next hundred. Accept the suggestion made by the Staff Side in its memorandum to 7 CPC for de-layering viz. to abolish the pay levels pertaining to GP 1900, 2400 and 4600.

3. Revise the rate of increment to 5 % and Grant two increments in the feeder cadre levels as promotion benefit.

4. Fill up all vacant posts by holding special recruitment drive

5. MACP to be treated as financial up-gradation, without any grading stipulation; to be provided on the basis of the promotional cadre hierarchy of the concerned department; increase the number of MACP to five on completion of 8, 15,21,26 and 30th years of service. Reject the Efficiency Bar stipulation made by 7th CPC. Personnel promoted on the basis of Examination should be treated as fresh entrants to the cadre.

6. Upgrade the LDCs in all departments as UDCs for it is stated by the Commission that the Government has stopped recruiting personnel to this cadre.

7. a) Parity to be ensured for all Stenographers, Assistants, Ministerial Staff in subordinate offices and in all the organized Accounts cadres with Central Sectt. By upgrading their pay scales ( and not by downgrading the pay scales of the CSS)

b) Drivers in all Government offices to be granted pay scale on par with the drivers of the Lok Sabha

8. To remove existing anomaly, the annual increment date may be 1st January for those recruited prior to 30th June and 1stJuly in respect of those recruited prior to 31st December.

9. Wage of Central Government Employees be revised in every 5 years

10. Treat the GDS as Civil Servant and grant them all pay, allowances and benefits granted to regular employees on Pro -rata basis

11. Contract/casual and daily rated workers to be regularized against the huge vacancies existing in various Government offices.

12. Introduce PLB in all departments

13 Revise the pension and other retirement benefits as under:-

(a) Parity between the past and present pensioners to be brought about on the basis of the 7th CPC recommendations with the modification that basis of computation to be the pay level of the post or grade from which one retired;

(b) Pension to be 60% of the last pay drawn in the case of all eligible persons who have completed the requisite number of years of service.

(c) The family pension to be 50% of the last pay drawn.

(d) Enhance the pension and family pension by 5% after every five years and 10% on attaining the age of 85 and 20% on attaining the age of 90.

(e) Commuted value of pension to be restored after 10 years or attaining the age of 70, whichever is earlier. Gratuity calculation to be on the basis of 25 days in the month as against 30 days as per the Gratuity Act.

(f) Fixed medical allowance for those pensioners not covered by CGHS to be Rs. 2000 p.m.

(g) Provide one increment on the last day in service if the concerned employee has completed six months or more from the date of grant of last increment.

14 Exclude the Central Government employees from the ambit of the National Pension Scheme and extend the defined benefit pension scheme to all those recruited after 1.1.2004

15 In the absence of any recommendation made by 7 CPC, the Government must withdraw the stipulated ceiling on compassionate appointments

16 Revise the following allowances/advances as under in place of the recommendations made by the 7th CPC :

(i) Allowances

(a) Retain the rate of house rent allowance in place of the recommendation of the Commission to reduce it.

(b) Restructure the transport allowance into two slabs at Rs. 7500 and 3750 with DA thereof removing all the stipulated conditions.

(c). Fixed conveyance allowance: This allowance had no DA component at any stage.. This allowance must be enhanced to 2.25 times with 25% DA thereon as and when the DA crosses 50%

(d) Restore the island Special duty allowance and the Tripura Special compensatory remote locality allowance.

(e) The special duty allowance in NE Region should be uniform for all at 30%

(f) Overtime allowance whenever sanction must be based upon the actual basic pay of the entitled employee

(g) Cash handling /Treasury allowance. The assumption that every transaction in Government Departments are through the bank is not correct. There are officials entrusted to collect cash and therefore the cash handling allowance to be retained.

(h)Qualification Pay to be retained.

(i) Small family norms allowances;

(j) Savings Bank allowance

(k) Outstation allowance

(l) P.O. & RMS. Accountants special allowance.

)m) Risk allowance

(n) Break-down allowance.

(o) Night patrolling allowance.

(p) Special Compensatory hill area allowance.

(q) Special allowance for Navodaya Vidyalaya Staff.

(r)Restore the allowances abolished for the reason that it is either not reported or mentioned in the Report by the Commission.

(s) Dress Allowance ceiling to be raised to Rs 20,000/- p a

(t) Nursing Allowance to be raised to 2.25 times of Rs 4800/-

(u) All fixed allowances must be raised to 2.25 times as per the principle enunciated by the Commission

(v) The erroneous statement in Para 9.2.5 to be corrected. Vide OM No. 13018/1/2009-Estt (L) dated 22.07.2009, DOP, P&W, the leave period for Child adoption has been increased to 180 days.

17 Advances.

Restore the following advances and revise the same to 3 times.

(a). Natural calamity advance;

(b). Festival Advance

©. LTC and TA advances

(d). Medical advance

(e). Education advance.

(f) Vehicle advances including cycle advance

18 The stipulation made by the 7th CPC to grant only 80% of salary for the second year of CCL be rejected and the existing provisions may be retained

19 50% of the CGEIS premium to be paid by the Government in respect of Group B and C employees.

20 Health insurance to be introduced in addition to CGHS and CCS(MA) benefits and the premium to be paid by the Government and the employee equally.

21 Reject the recommendations concerning PRIS

22 Full pay and allowances to be provided for the entire period of WRII .

23 The conditions stipulated in clause (4) & (5) under Para 9.2.37 be removed

24 Reject the recommendation made by the 7th CPC in Para 8.16.9 to 8.16.14 concerning dress allowance to PBOR as otherwise the five Ordinance Equipment factories under OFB will have to be closed down

25 Set up a group of Ministers’ Committee to consider the anomalies including the disturbance of the existing horizontal and vertical relativities at the National level and Departmental/Ministry level with provision for referring the disputed issues to the Board of Arbitration under the JCM scheme.

Saturday 12 December 2015

Friday 4 December 2015

Letter of Offg. Circle Secretary to General Secretary and Secretary General regarding Meeting with Staff Side Representatives of Departmental Council (JCM) to discuss issues relating to recommendations of the Seventh Pay Commission.

N.F.P.E.

ALL INDIA

Com. A B Shivtare, Offg. Circle Secretary,

Add : C/oHRO, RMS B Division, Pune 411001

PH : 9404962745, 9762768201

No. MH/RIII/7thCPC/Review/2015-16 Dated :04-12-2015

To,

1. Com. R N Parashar

Secretary General,

National Federation of Postal Employees

CHQ, New Delhi

2. Com. Giriraj Singh

General Secretary,

AIRMS & MMS Employees Union Gr, C,

CHQ, New Delhi

Subject : Meeting with Staff Side Representatives of Departmental Council (JCM) to discuss issues relating to recommendations of the Seventh Pay Commission.

Respected comrade,

I wish to following points to be brought to the notice of the directorate , Department of Posts India during the discussion Staff Side Representatives of Departmental Council (JCM) to discuss issues relating to recommendations of the Seventh Pay Commission.

- The commission had recommended Rs.18000 as minimum wages. The same should be enhanced to Rs.26000

- Some of the cadres of Department of Posts are restructured by the 7th CPC. On the line of that following cadres are also required to be restructured and awarded pay fixation benefits:

a. Postal/Sorting Assistants may be upgraded to the Grade Pay of Rs. 2800.

b. PO/RMS Accountant, System Administrator, Marketing Executive, MACP-I may be upgraded to Grade pay of s. 4200.

c. In the 3rd, 4th, 5th and 6th CPC, the Inspector of Posts, Lower Selection Grade (Normed Base) Supervisor and TBOP (Time Bound One Promotion) official were placed in the same Pay Scale. Now the 7th CPC has upgraded the cadre of Inspector of Posts with Grade Pay to Rs. 4600, neglecting other equivalent cadres. Hence, Lower Selection Grade (Normed Base) Supervisor and TBOP (Time Bound One Promotion) official now MACP-II may be upgraded to the Grade Pay of Rs. 4600 at par that of Inspector of Posts.

d. In the 3rd, 4th and 5th CPC, Higher Selection Grade-II (HSG-II), BCR official and the Assistant Supdt. of Posts were placed in the same Pay Scale. The 7th CPC has upgraded the cadre of Assistant Supdt. of Posts with Grade Pay to Rs. 4800, neglecting other equivalent cadres. Hence, Higher Selection Grade (HSG-II) and BCR now MACP-III official may be upgraded to the Grade Pay of Rs. 4800 at par that of Assistant Supdt. of Posts.

e. In the 3rd, 4th and 5th CPC, the cadre of Higher Selection Grade-I (Non-gazetted Gr. ‘B’) and the Superintendent of Posts were placed in the same Pay Scale. In the 6th CPC HSG-I is upgraded from the pay scale of Rs. 6500 to the pay scale of Rs. 7450. However, same is ignored in recent recommendation of 7th CPC.

H.S.G-I is over all Incharge of the actual revenue generated functional works and whole responsibility lies on them. Ignoring the cadre of Supervisor (LSG NB

With effect from 2003, 75% Supervisory posts are being fed buy conducting competitive examinations (Fast Track Promotion) from the feeder cadre of Sorting Assistants/Postal Assistants but no any financial up gradation consider till today. In the cadre restructuring it was considered by Directorate and proposed to upgrade to the Grade Pay of HSG-I cadre from Rs. 4600 to Rs. 4800 i.e. equivalent to the Superintendent. The 7th CPC has upgraded the cadre of Superintendent of Posts with Grade Pay to Rs. 5400, but not considered the same for the equivalent cadre of HSG-I.

According to the revised Recruitment of Rules of the Assistant Supdt. of Posts issued by the Dept. of Posts, HSG-I is the promotion to the ASP after rendering two years of regular service. The 7th CPC has upgraded the Grade pay of the cadre of ASP to Rs. 4800/- To award natural justice, the cadre of Higher Selection Grade (HSG-I) may also be upgraded by the higher Grade Pay than that of ASP Cadre.

Recently the Department of Posts has issued Revised Recruitment Rules of the superintendent wherein some posts of reserved for the HSG-I cadre. For the Superintendent and HSG-I, the feeder cadre is same i.e. Sorting Assistant/Postal Assistant. Hence, as the Grade Pay of the Superintendent is upgraded to Rs. 5400 on the same line the Grade Pay of the H.S.G.-I cadre is also to be upgraded to Rs.5400 by the 7th CPC.

- The fitment benefit recommended may be increased from 2.57 to 3.00 for all cadres.

- The House Rent Allowance (HRA) has also been reduced from 10, 20 and 30 per cent to 8, 16 and 24 per cent respectively. The same may be kept as it is.i.e.10, 20 & 30 %

- Two increments at the time of promotion may be provided to compensate the enhancement in grade pay at the time of promotion as the commission had scrapped out the Grade Pay system.

- The rate of increment may be increased from 3% to 5%. Performance based increments after 20th years of service should be scrapped. Increment should be allowed every year.

- Bench marks should be scrapped for the MACP. At least 4 MACPs should be awarded during the service i.e. after completion of service 8th 16th 24th and 30thyears.

- As recommended by the 6th pay commission, the official who has rendered six months service during the year was eligible for yearly increment on 1st July. On this line the official who had completed six months qualifying service and being retired between 1st January to 30th June, one increment may be allowed for pensionery benefits.

- Allowances and advances are being allowed on the basis of National policies. Hence, various allowances and advances disallowed by the 7th CPC may be restored.

I shall remain highly thankful to you for doing the needful.

( A B SHIVTARE)

Offg. Circle Secretary

AIRMS& MMS Employees Union Gr C

Officiating arrangement of circle secretary R-III MH Circle

Charge of officiating circle secretary handed over to

Shri A B Shivtare, ACS , AIRMS & MMS Employees Union Gr C Maharashtra Circle

&

HSG-I, HSA, Parcel Hub, Pune 411006.

All are requested to please intimate their grievances, if any to be attended on priority basis during this officiating period on email Id. arvindshivtare@gmail.com

Mobile no. 940496275, 9762768201

Mailing Address is :C/o HRO, RMS B Division, Pune 411001

Thursday 26 November 2015

DECEMBER 1st & 2nd , 2015 STRIKE DEFERRED

SECRETARY GENERAL AND ALL GENERAL SECRETARIES OF NFPE & AIPEU GDS (NFPE) WILL SIT ON TWO DAYS HUNGER FAST INFRONT OF DAK BHAWAN, NEW DELHI ON 1st & 2nd DECEMBER 2015.

ONE DAY MASS HUNGER FAST IN FRONT OF ALL CPMG / PMG & DIVISIONAL OFFICES ON 11th DECEMBER 2015.

Sunday 22 November 2015

CALCULATE YOUR 7 CPC PAY IN EXCEL FILE DOWNLOAD EXCEL FILE LINK

CALCULATE YOUR 7CPC PAY EXCEL FILE ON FOLLOWING LINK

DOWNLOAD HERE

1. EASY TO CALCULATE

2. ONLY FOR PB 1 AND PB 2 BANDS

3. OPEN IN 2007 AND 2010 EXCEL

4. NO VBA CODE ENABLE SYSTEM SIMPLE

..

..

FOR NFPE PUNE

DOWNLOAD HERE

1. EASY TO CALCULATE

2. ONLY FOR PB 1 AND PB 2 BANDS

3. OPEN IN 2007 AND 2010 EXCEL

4. NO VBA CODE ENABLE SYSTEM SIMPLE

..

..

FOR NFPE PUNE

Saturday 21 November 2015

STEP BY STEP MODEL CALCULATION FOR ARRIVING YOUR NEW PAY AFTER 7TH CPC IMPLEMENTATION

The step by step method to calculate your new Pay after implementation of 7th CPC recommendations.

To calculate your Basic Pay and Allowance for Civilian Employees follow the steps given below.

First we need your Basic pay which is GP + Band Pay

Let us see a model calculation. We assume your Band pay as 8770 and GP as 2400

Basic Pay = 8770 + 2400 = 11170

Next step is to multiply the above figure with 7th CPC Fitment Factor

If the image is not clear, use the larger matrix table given on the bottom of this article

In the table you can see the fitment factors corresponding to each GP

In this case GP is 2400. So the fitment factor will be 2.57

Multiply your Basic pay with this fitment facor

ie, 11170 * 2.57 = 28706.9

Round off this figure to higher Rupee

Then we get 28707

Match this Answer with Matrix Table

- Choose the matching figure we arrived above in the matrix (Given below) or closest higher figure assigned in the Grade Pay column can be chosen

So we chose the next higher figure 29600

This is your New Basic Pay

Pay Matrix (Civilian Employees)

Identify your HRA

HRA has been revised as 24%, 16% and 8% for 30% , 20% and 10% respectively

So if you are in 30% HRA Bracket, your HRA in 7th CPC is 24% vis versa.

Let us assume now you are in 30% HRA bracket, your revised HRA is 24%

Find the 24% of the Basic Pay = 29600 x 24/100 = 7104

Your HRA is Rs.7104

Identify your TPTA (Transport Allowance)

7th CPC Recommends Transport Allowance for three Category of Employees for Two Types of Places

If you are living in A1 and A classified cities you will be entitled to get higher TPTA rates

And since your Grade Pay is 2400 you fall in Second category

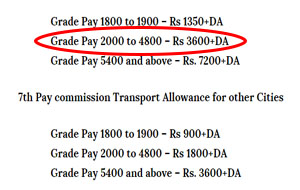

ie Grade Pay 2000 to 4800 = Rs 3600+DA

Your TPTA is Rs. 3600/- (DA is Nil as on 1.1.2016)

(Sine DA will be Zero from 1.1.2016 So no need to calculate the DA to calculate 7th Pay and Allowances from 1.1.2016)

Add all the figures

New Basic Pay + HRA+DA+TPTA = 29600+7104+0+3600 = 40304

Your revised 7th CPC Grass pay as on 1.1.2016 = Rs.40304

Friday 20 November 2015

GET READY FOR INDEFINITE STRIKE

Saturday, November 21, 2015

Thursday 19 November 2015

IMPORTANT RECOMMENDATIONS

1. DATD OF EFFECT – 01.01.2016

2. MINIMUM PAY – 18000

Dr. Aykroyd Formula of 15th Indian Labour Conference for calculation of Minimum wage distorted by 7th CPC to deny the eligible minimum pay.

3. FITMENT FORMULA – 2.57 TIMES

4. FIXATION ON PROMOTION – NO CHANGE – ONLY ONE INCREMENT IN THE OLD SCALE

5. ANNUAL INCREMENT – 3% NO CHANGE

6. MODIFIED ASSURED CAREER PROGRESSION – NO CHANGE – 10, 20, 30

Conditions made more stringent. Bench march “Very Good” required instead of “good”. No Examination for MACP proposed. Hierarchial promotion restored.

7. PAY BAND, GRADE PAY SYSTEM ABOLISHED

New Pension Structure called “Matrix based open ended pay structure” recommended. Total span of the scale 40 years.

8. MAXIMUM PAY INCREASE – 14.29%

9. COMPARISON BETWEEN MINIMUM AND MAXIMUM PAY – 1:11.4 (18000 : 205400)

10. NUMBER OF PAY SCALES – NOT REDUCED - NO DELAYERING

11. ALLOWANCES – NO IMPROVEMENT

Commission recommended abolition of 52 existing allowances such as Assisting Cashier Allowance, Cash Handling Allowance, Treasury Allowance, Handicapped Allowance, Risk Allowance, Savings Bank Allowance, Special compensatory (Hill Area) Allowance, Cycle Allowance, Family Planning Allowance etc.

12. HRA REDUCED TO 24%, 16% AND 8% FOR X, Y AND Z CITIES

The Commission also recommends that the rate of HRA will be revised to 27 Report of the Seventh CPC 869 Index percent, 18 percent and 9 percent when DA crosses 50 percent, and further revised to 30 percent, 20 percent and 10 percent when DA crosses 100 percent.

13. DRIVERS – HIGHER PAY SCALE REJECTED

14. DA FORMULA – NO CHANGE

15. HBA – NO CHANGE – CEILING RAISED TO 25 LAKHS

16. CASUAL LEAVE – NO INCREASE

17. CHILD Care Leave

1st 365 days – Full pay (100%)

Next 365 days – 80% Pay only.

18. MATERNITY LEAVE – NO CHANGE -

19. LEAVE ENCASHMENT AT THE TIME OF RETIREMENT – NO INCREASE MAXIMUM 300 DAYS ONLY

20. MEDICAL

Medical Insurance Scheme for serving and retired employees recommended.

21. TRANSPORT ALLOWANCE - NO HIKE - ONLY 125% MERGER

Pay Level

|

Higher Transport Allowance cities (A, AI)

|

Other places

|

9 and above

|

7200 + DA

|

3600 + DA

|

3 to 8

|

3600 + DA

|

1800 + DA

|

1 and 2

|

1350 + DA

|

900 + DA

|

22. LEAVE TRAVEL CONCESSION (LTC) – NO CHANGE

One time LTC to Foreign Country during the service rejected. Splitting of Home Town LTC for employees Posted in North East, Laddakh, Andaman & Nicobars and Lakshdweep allowed.

23. ACCOUNTS STAFF BELONGING TO UNORGANIZED ACCOUNTS – PARITY WITH ORGANISED ACCOUNTS REJECTED.

24. PERIODICAL REVIEW OF WAGES (NOT TEN YEARS) RECOMMENDED. NO PAY COMMISSION REQUIRED

25. PERFORMANCE RELATED PAY SHOULD BE INTRODUCED IN GOVERNMENT SERVICES AND ALL BONUS PAYMENT SHOULD BE LINKED TO PRODUCTIVITY.

26. COMPULSORY RETIREMENT AND EFFICIENCY BAR REINTRODUCED

Failure to get required bench MarK for promotion within the first 20 years of service will result in stoppage of increment. Such employees who have out lived their ability, their services need not be continued and the continuance of such persons in the service should be discouraged.

27. PROMOTEE AND DIRECT RECRUITS – ENTRY LEVEL PAY ANOMALY IS REMOVED

28. CADRE REVIEW TO BE COMPLETED IN A TIME BOUND MANNER.

Commission recommended to hasten the process of cadre review and reduced the time taken in inter-ministerial consultations.

29. NEW PENSION SCHEME – WILL CONTINUE

30. Children Education Allowance & HOSTEL SUBSIDY

Rate

| Component | Recommended Rate | Remarks |

| CEA (₹ pm) | 1500 x 1.5 =2250 | Whenever DA increases by 50%, CEA shall increase by 25% |

| Hostel Subsidy (₹ pm) | 4500 x 1.5 = 6750 | Whenever DA increases by 50%, Hostel Subsidy shall increase by 25% |

The allowance will continue to be double for differently disabled children.

- What should be the scope of CEA? Presently CEA is payable up to Class XII. There is a strong demand for increasing the scope to Graduate and Post Graduate studies. However, due to the greatly varying nature of studies at the graduate level and beyond, the extension of scope of the allowance beyond Class XII cannot be accepted.

Simplification of Procedure for Reimbursement. This is a major area of concern. Many representations have been received by the Commission wherein employees have stated that due to cumbersome procedures, reimbursement has been held up for years. Another issue is the kind of voucher which will be accepted and which kind of voucher will not. The issue has been examined, and the apprehensions expressed are not without merit. It is recommended that reimbursement should be done just once a year, after completion of the financial year (which for most schools coincides with the Academic year). For CEA, a certificate from the head of institution where the ward of government employee studies should be sufficient for this purpose. The certificate should confirm that the child studied in the school during the previous academic year. For Hostel Subsidy, a similar certificate from the head of institution should suffice, with the additional requirement that the certificate should mention the amount of expenditure incurred by the government servant towards lodging and boarding in the residential complex. The amount of expenditure mentioned, or the ceiling as mentioned in the table above, whichever is lower, shall be paid to the employee.

31. GROUP INSURANCE SCHEME

Level Monthly Contribution Insurance Amount

1 to 5 1500 15 Lakhs

6 to 9 2500 25 lakhs

10 and above 5000 50 lakhs

PENSIONARY BENEFITS

32. PENSIONERS – PARITY – LONG STANDING DEMAND OF THE PENSIONERS ACCEPTED

Commission recommends a revised Pension Formulation for Civil employees and Defence Personnel who have retired before 01.01.2016. (expected date of implementation of seventh CPC recommendations). This formulation will bring about complete parity of past pensioners with current retirees.

33. PENSIONERS – MINIMUM PENSION RS. 9000/-

(50% of the minimum pay recommended by the 7th CPC)

34. PENSIONERS – GRATUITY CEILING RAISED TO 20 LAKHS

35. PENSIONERS – FIXED MEDICAL ALLOWANCE (FMA) – NO CHANGE (RS. 500/-

36. CGHS FACILITIES TO ALL POSTAL PENSIONERS RECOMMENDED

33 Postal dispensaries should be merged with CGHS

37. GRAMIN DAK SEVAKS (GDS) OF THE POSTAL DEPARTMENT DEMAND FOR CIVIL SERVANTS STATUS REJECTED

Recommendation: - The committee carefully considered the demand for treating the Gramin Dak Sevaks as civil servants at par with other regular employees for all purposes, and noted the following:

(a) GDS are Extra-Departmental Agents recruited by Department of Posts to serve in rural areas.

(b) As per the Recruitment Rules the minimum educational qualification for recruitment to this post is class X.

(c) GDS are required to be on duty only for 4 to 5 hours a day under the terms and conditions of their service.

(d) The GDS are remunerated with Time Related continuity Allowance (TRCA) on the pattern of pay scales for regular Government employees plus DA on pro-rata basis.

(e) A GDS must have other means of income independent of his remuneration as a GDS to sustain himself and his family.

Government of India has so far held that GDS is outside the Civil Service of the Union and shall not claim to be at par with the Central Government Employees. The Supreme Court Judgment also states that GDS are only holder of Civil posts but not civilian employees. The Commission endorses this view and therefore has no recommendation with regard to GDS.

38. ADDITIONAL POST ALLOWANCE FOR POSTMAN

10% of Basic Pay if one shares the another Postmen duty. If it is shared by two Postmen, it will be 5% for both.

39. HOLDING MONETARY COMPENSATION

Supervisor, PA, Sorting Postman – Rs. 200/- per holiday.

MTS – Rs. 150/- per holiday

40. ADDITIONAL WORK ALLOWANCE

2% of the Basic Pay per month

10% of the Basic pay if period exceeds 45 days.

41. IP/ASP/SP SCALE UPGRADED

Commission has noted that the VI CPC had placed Inspector (Posts) at par with Inspector of CBDT/CBED. Subsequently the Inspector of CBDT/CBE were elevated to GP 4600. The Commission has further noted that the Inspector of Posts and Inspector of CBDT/CBED are recruited through the same combined graduate level examination. Therefore the commission recommended 4600 GP for IP and 4800 GP and 5400 GP for SPOs.

Subscribe to:

Posts (Atom)

FOR PERSONAL ATTENTION OF ALL GENERAL SECRETARIES/NFPE OFFICE BEARERS/ALL INDIA OFFICE BEARERS/CIRCLE SECRETARIES/DIVISIONAL & BRANCH SECRETARIES OF NFPE UNIONS

MAKE THE ALL PHASED AGITATIONAL PROGRAMMES AS MENTIONED BELOW A GRAND SUCCESS FOR SETTLEMENT OF 10 POINTS CHARTER OF DEMANDS AGITATIO...

-

MAKE THE ALL PHASED AGITATIONAL PROGRAMMES AS MENTIONED BELOW A GRAND SUCCESS FOR SETTLEMENT OF 10 POINTS CHARTER OF DEMANDS AGITATIO...

-

To, The CPIO, Hon’ble Vijay Malhotra Under Secretary Government of India, Ministry of Finance, Department of Financial S...

-

click on follwing link to download certificate CLICK HERE FOR MEDICAL FIT UNFIT CERTIFICATE