1 Minimum Pay: After considering all relevant factors and based on the

Aykroyd formula the minimum pay in government is recommended to be set at

₹18000 per month. (chapter 4.2)

2 New Pay Structure: The present system of pay bands and grade pay has been

dispensed with and a new pay matrix has been designed. The status of the

employee, hitherto determined by grade pay, will now be determined by the level

in the pay matrix. Separate pay matrices have been drawn up for civilians,

defence personnel and for military nursing service. All existing levels have

been subsumed in the new structure; no new levels have been introduced nor has

any level been dispensed with. (paras 5.1.13 to 5.1.17)

3 In the “horizontal range” of the pay matrix level

corresponds to a ‘functional role in the hierarchy’ and as the employee’s level

rises he or she moves from level to level. The “vertical range” for each level

denotes ‘pay progression’ within that level and an employee would move vertically

within each level as per the annual financial progression of three percent. The

starting point of the matrix is the minimum pay which has been arrived based on

15th ILC norms or the Aykroyd formula. (para 5.1.21)

4 Fitment: The

starting point for the first level of the matrix has been set at ₹18,000. This

corresponds to the present starting pay of ₹7,000, which is the beginning of

PB-1 viz., ₹5200 + GP 1800, on the date of implementation of the VI CPC

recommendations. Hence the starting point now proposed is 2.57 times of what

was prevailing on 01.01.2006. This fitment factor of 2.57 is being proposed to

be applied uniformly for all employees. (para 5.1.27)

5 Annual Increment: The rate of annual increment is being retained at 3

percent. (para 5.1.38)

6 Entry Pay:

The differential of entry pay between new recruits and promoted employees at

various levels has been done away with. (para 5.1.32 and para 5.1.33)

7 Modified Assured Career Progression (MACP): i. This will continue to be administered

at 10, 20 and 30 years as before. ii. In the new Pay matrix, the employees will

move to the immediate next level in the hierarchy. iii. In the interest of

improving performance level, the benchmark for MACP has been recommended to be

enhanced from ‘Good’ to ‘Very Good.’ Report of the Seventh CPC 866 Index iv.

The Commission has proposed withholding of annual increments in the case of

those employees who are not able to meet the benchmark either for MACP or a

regular promotion within the first 20 years of their service. (paras

5.1.44-5.1.46)

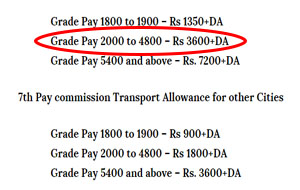

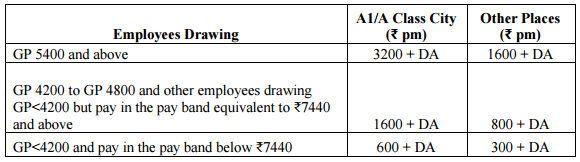

8. Allowances: The entire structure of allowances have been examined de

novo with the overall aim of transparency, simplification and rationalization,

keeping amongst other things, the proposed pay structure in mind. The

Commission has recommended abolishing 52 allowances altogether. Another 36

allowances have been abolished as separate identities, but subsumed either in

an existing allowance or in newly proposed allowances. Particular emphasis has

been placed on simplifying the process of claiming allowances. Allowances

relating to Risk and Hardship will be governed by the proposed Risk and

Hardship Matrix. (para 8.2.5)

9. Most of the allowances that have been retained have been

given a raise that is commensurate with the rise in DA. Allowances that are in

the nature of a fixed amount but fully indexed to DA have not been given any

raise. Regarding percentage based allowances, since the Basic Pay will rise as

a result of the recommendations of this Commission, the quantum of percentage

based allowances has been rationalized by a factor of 0.8. (para 8.2.3)

10. Risk and Hardship Allowance: Allowances relating to Risk and

Hardship will be governed by the newly proposed nine-cell Risk and Hardship

Matrix, with one extra cell at the top, viz., RH-Max to include Siachen

Allowance. This would be the ceiling for risk/hardship allowances and there

would be no individual RHA with an amount higher than this allowance. (para

8.10.65 and para 8.10.66)

11.House Rent Allowance: In line with our general policy of rationalizing the

percentage based allowances by a factor of 0.8, the Commission recommends that

HRA should be rationalized to 24 percent, 16 percent and 8 percent of the Basic

Pay for Class X, Y and Z cities respectively. The Commission also recommends

that the rate of HRA will be revised to 27 Report of the Seventh CPC 869 Index

percent, 18 percent and 9 percent when DA crosses 50 percent, and further

revised to 30 percent, 20 percent and 10 percent when DA crosses 100 percent.

(para 8.7.15)

12. Currently, in the case of those drawing either NPA or

MSP or both, the amounts of NPA/MSP are included with the Basic Pay and HRA is

being paid as a percentage of the total amount. The Commission recommends that

HRA should be calculated as a percentage of Basic Pay only and that add-ons

like NPA, MSP, etc. should not be included while working out HRA. (para 8.7.16)

13. The Commission, in the interactions it has had with the men on the

ground at all field locations it has visited, has seen first-hand that the lack

of proper housing compensation is a source of discontentment among these

employees. The service rendered by PBORs of uniformed services needs to be

recognized and Housing provisions of PBORs of Defence, CAPFs and Indian Coast

Guard have been simplified and HRA coverage has been extended to them. (para

8.7.26)

14. Uniform related allowances have been amalgamated under a

simplified Dress Allowance payable annually. It is thus recommended that

uniform related allowances be subsumed in a single Dress Allowance (including

shoes). (para 8.16.14)

15. Any allowance,

not mentioned here (and hence not reported to the Commission), shall cease to

exist immediately. In case there is any demand or requirement for continuation

of an existing allowance which has not been deliberated upon or covered in this

report, it should be re-notified by the ministry concerned after obtaining due

approval of Ministry of Finance and should be put in the public domain. (para

8.2.5)

17. OTA should be abolished (except for operational staff and

industrial employees who are governed by statutory provisions). At the same

time it is also recommended that in case the government decides to continue

with OTA for those categories of staff for which it is not a statutory

requirement, then the rates of OTA for such staff should be increased by 50

percent from their current levels. (para 8.17.97)

18. All non-interest bearing Advances have been abolished.

(para 9.1.4) Report of the Seventh CPC 870 Index

19. Regarding Motor Car Advance and Motor

Cycle/Scooter/Moped Advance, since quite a few schemes for purchase of vehicles are available

in the market from time to time. The employees should avail of these schemes

and both these advances should be abolished. (para 9.1.7)

20. Regarding other interest-bearing advances, the following

is recommended: (para 9.1.8) (i) PC Advance ₹50,000 or actual price of PC,

whichever is lower May be allowed maximum five times in the entire service.

(ii) HBA 34 times Basic Pay OR ₹25 lakh OR anticipated price of house,

whichever is least The requirement of minimum 10 years of continuous service to

avail of HBA should be reduced to 5 years. If both spouses are government

servants, HBA should be admissible to both separately. Existing employees who

have already taken Home Loans from banks and other financial institutions

should be allowed to migrate to this scheme.

21. The three different kinds of leave admissible to

civilian/defence employees which are granted for work related

illness/injuries–Hospital Leave, Special Disability Leave and Sick Leave are

being subsumed and rationalized into a composite new Leave named Work Related

Illness and Injury Leave (WRIIL). (para 9.2.36) 1. Full pay and allowances will

be granted to all employees during the entire period of hospitalization on

account of WRIIL. 2. Beyond hospitalization, WRIIL will be governed as follows:

a. For Civilian employees, RPF employees and personnel of Police Forces of

Union Territories: Full pay and allowances for the 6 months immediately

following hospitalization and Half Pay only for 12 months beyond that. The Half

Pay period may be commuted to full pay with corresponding number of days of

Half Pay Leave debited from the employee’s leave account. b. For Officers of

Defence, CAPFs, Indian Coast Guard: Full pay and allowances for the 6 months

immediately following hospitalization, for the next 24 months, full pay only.

c. For PBORs of Defence, CAPFs, Indian Coast Guard: Full pay and allowances,

with no limit regarding period.

22. The Rates of contribution as also the insurance coverage

under the Central Government Employees General Insurance Scheme have remained

unchanged for long. The following rates of CGEGIS are recommended: (para 9.3.6)

Report of the Seventh CPC 871 Index Level of Employee Monthly Deduction (₹)

Insurance Amount (₹) 10 and above 5000 50,00,000 6 to 9 2500 25,00,000 1 to 5

1500 15,00,000

23. A simplified process for Cadre Reviews and revamping of

the screening process under Central Staffing Scheme have been recommended.

(para 7.3.41)

24. Health Insurance: The Commission strongly recommends the introduction of

health insurance scheme for Central Government employees and pensioners. In the

interregnum, for the benefit of pensioners residing outside the CGHS areas, the

Commission recommends that CGHS should empanel those hospitals which are

already empanelled under CS (MA)/ECHS for catering to the medical requirement

of these pensioners on a cashless basis. This would involve strengthening of

administrative capacity of nearest CGHS centres. The Commission recommends that

the remaining 33 postal dispensaries should be merged with CGHS. The Commission

further recommends that all postal pensioners, irrespective of their

participation in CGHS while in service, should be covered under CGHS after

making requisite subscription. The Commission recommends that possibility of

such a combined network of various medical schemes should be explored through

proper examination. (para 9.5.18)

25. Pension: The Commission recommends a revised pension formulation for

civil employees including CAPF personnel and Defence personnel, who have

retired before 01.01.2016. This formulation will bring about complete parity of

past pensioners with current retirees: i. All the personnel who retired prior

to 01.01.2016 (expected date of implementation of the Seventh CPC

recommendations) shall first be fixed in the Pay Matrix being recommended by

this Commission, on the basis of the Pay Band and Grade Pay at which they

retired, at the minimum of the corresponding level in the matrix. This amount

shall be raised, to arrive at the notional pay of the retiree, by adding the

number of increments he/she had earned in that level while in service, at the

rate of three percent. Fifty percent of the total amount so arrived at shall be

the revised pension. In the case of the Defence personnel, total amount so

arrived at shall be inclusive of MSP. ii. The second calculation to be carried

out is as follows. The pension, as had been fixed at the time of implementation

of the VI CPC recommendations, shall be multiplied by 2.57 to arrive at an

alternate value for the revised pension. iii. Pensioners may be given the

option of choosing whichever formulation is beneficial to them. (para 10.1.67)

17.42 Since the fixation of pension as per formulation (i) above may take a

little time it is recommended that in the first instance the revised pension

may be calculated as at (ii) above Report of the Seventh CPC 872 Index and the

same may be paid as an interim measure. In the event calculation as per (i)

above yields a higher amount the difference may be paid subsequently. (para

10.1.68)

26. The Commission recommends enhancement in the ceiling of

gratuity from the existing ₹10 lakh to ₹20 lakh from 01.01.2016. The Commission further recommends,

as has been done in the case of allowances that are partially indexed to

Dearness Allowance, the ceiling on gratuity may increase by 25 percent whenever

DA rises by 50 percent. (para 10.1.37)

27. Disability Pension: Keeping in view the tenets of equity, the Commission

is recommending reverting to a slab base system for disability element, instead

of existing percentile based disability pension regime. Distinct rates

separately for officers, JCOs and ORs have been prescribed. (para 10.2.55)

28. Ex-gratia Lump sum Compensation to Next of Kin: The Commission is recommending the

revision of rates of lump sum compensation for next of kin (NOK) in case of

death arising in five separate circumstances, to be applied uniformly for the

defence forces personnel and civilians. (para 10.2.77) Circumstances Proposed

(₹) Death occurring due to accidents in course of performance of duties. 25

lakh Death in the course of performance of duties attribute to acts of violence

by terrorists, anti-social elements etc. 25 lakh Death occurring in border skirmishes

and action against militants, terrorists, extremists, sea pirates 35 lakh Death

occurring while on duty in the specified high altitude, inaccessible border

posts, on account of natural disasters, extreme weather conditions 35 lakh

Death occurring during enemy action in war or such war like engagements, which

are specifically notified by Ministry of Defence# and death occurring during

evacuation of Indian Nationals from a wartorn zone in foreign country 45 lakh

Report of the Seventh CPC 873 Index